This week is set to be a tumultuous one for Tesla as investors seek answers about robotaxis, the stock price and Musk’s compensation.

Even experienced Tesla watchers and Elon-ologists like me will tell you the electric automaker is in an especially weird moment—and for Tesla, that’s really saying something. The stock price is way down, sales are too, the path forward feels more uncertain than ever as it apparently hinges on robotaxis, and the CEO spent the weekend posting about slavery and pedophiles.

Meanwhile, he’s asking investors to approve an unprecedentedly large $56 billion compensation package at the company’s annual meeting this summer—something approved at a very different time in Tesla’s history, and one that has been through significant legal turmoil just recently.

Yeah. It’s a lot. So today’s edition of Critical Materials is all about Tesla, because we need to parse what’s going on—maybe even what’s going wrong—at that company ahead of the Tuesday evening’s important Q1 earnings call. Let’s dig in.

30%: Tesla’s Retail Investors Are Getting Nervous

For those not familiar with the term, retail investors are non-professional investors (typically individuals) who put money into a company in hopes of financial gain. $TSLA is immensely popular with retail investors; you may even be one of them. And lately, they’re as miffed as anyone by what’s going on at Tesla.

The automaker has set up a Say channel for those investors to ask questions ahead of the earnings call—an event where Musk is expected to answer for the declining sales and say at least something about the robotaxi plan. And as Fortune pointed out, many of those investors are not happy with the state of things:

Tesla says it has one of the largest retail stockholder bases of any publicly traded company, and that they are “incredibly engaged and tend to have a very strong understanding of the company, and are an important base of support and feedback for management and the board,” Tesla said this week. Most companies of Tesla’s size are dominated by large institutional investors who interact with the company through preset engagement meetings rather than the more informal channels that smaller retail investors work through.

To be sure, not all the sentiment in the Q&A about Musk so far has focused on his conduct. The top-voted question about the Tesla CEO was in favor of approving his compensation and ensuring his control remains intact.

“Is the board working on a package to give Elon the 25% voting rights? I hope the answer is ‘yes,’ which leads to: Can it be expedited? Times are wasting,” said one anonymous retail investor with 265,000 shares.

Another small investor with 8,200 shares asked: “Why does Tesla’s board think that despite falling deliveries, tanking share price, increased China competition, lack of AI innovation, and a court finding of excessive compensation, Elon Musk merits restoration of his $54B executive compensation package?”

You can see more of their questions and comments over here, and for a crowd as die-hard as Tesla’s investor base is, the vibe is as scathing as I have ever seen:

“If we vote for your comp package will you please at least appear to make Tesla your top priority? (Not saying crazy things on Twitter would be nice too.)”

“Is there any discussion about oversight of Elon’s erratic behavior on X that is damaging the Tesla brand?”

“It’s clear that public perception of the company has taken a big hit due to Elon’s erratic behavior, and the negative trend has been accelerating since the X acquisition. What’s the threshold for reigning that in, or promoting someone more professional to lead the organization?”

“Elon, can you please let investors know how you prioritize TESLA vs. X/Twitter vs. US immigration policy? A few years ago it seemed clear to me the ranking, but today it’s not clear to me as an investor & outsider.”

And so on.

Granted, plenty of diehard $TSLA folks continue to be completely undaunted here. But for a company long defined by its unshakable faith in Musk and the mission, it does feel like cracks are showing more than ever before.

Investors will be able to vote on Musk’s pay package at Tesla’s annual shareholder meeting in June, so that matter won’t be settled this week. But Tuesday evening’s Q1 earnings call may have a lot to do with their mood later on.

60%: Tesla Is Losing Democrats

To me, it’s a shame that electric vehicles have become so politicized. It’s just a form of technology; it doesn’t need to be a source of naked partisan division. But for now, at least, coastal and more left-leaning places are the areas more likely to jump into EV adoption.

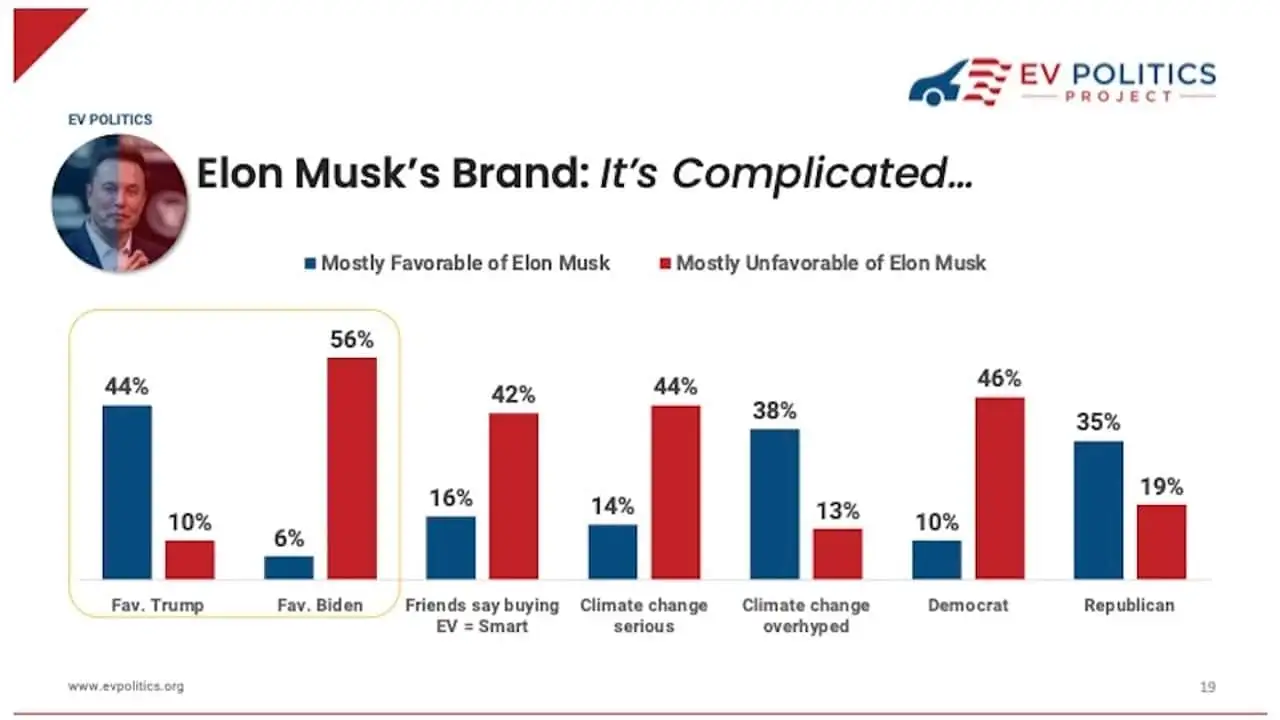

And as Tim Higgins at the Wall Street Journal—one of the best Elon-ologists out there, in my opinion—reports that Musk’s antics are turning off Democrats at a time when it really can’t afford to lose any new buyers:

Among 2022 model-year buyers, Democrats made up 40% of Tesla customers and 39% in 2023, according to Strategic Vision’s surveys. Things began to change in the 2024 model year survey, which began in October. The makeup of Democrats fell to 15% while Republicans jumped to 32% and independents swelled to 44%.

Those results show Tesla was losing sales among Democrats, Alexander Edwards, president of Strategic Vision, said of the fall findings.

In California, a solid-blue state, registrations of new Tesla vehicles fell almost 10% in the fourth quarter. That was a stunning reversal from the third quarter when registrations rose 43%, and perhaps a sign of things to come nationally.

Tesla doesn’t release U.S.-specific sales results. But Motor Intelligence estimates Tesla’s U.S. sales growth turned negative this year. Model 3 sedan sales fell 44% in the period that ended in March compared with a year ago, according to the research firm. Model Y sport-utility vehicles rose just 1.4%.

Musk, for his part, has said before that he doesn’t plan on stepping off his public pedestal. And I also think Tesla’s own sliding sales in places like California have a lot to do with the fact that the lineup is getting old as well. But right now, Tesla could use some wins, and the X/Twitter stuff is just not helping.

90%: Tesla’s Price Cuts Go Global

Meanwhile, Tesla continues to slash prices, and not just in the U.S. like we saw this weekend. Here’s Quartz to explain:

The automaker cut the price of the revamped Model 3 in China by 14,000 yuan ($1,930) to 231,900 yuan ($32,000). It also cut Model Y prices by a similar amount. Musk also trimmed the price of one model of the Model 3 in Germany to 40,990 euros ($43,670.75) from 42,990 ($45,750) euros.

In the U.S., Tesla slashed $2,000 off Model Y SUVs, Model X SUVS, and Model S sedans by $2,000. It also cut $4,000 off the price of Tesla’s Full Self-Driving amid a push to increase its collection of user data; just days earlier, the company slashed the subscription price of the software to $99 per month from $199 per month.

Prices across other countries in Europe, the Middle East, and Africa — areas where, as of last week, Musk now oversees Tesla sales — have also been slashed, Reuters reported.

If you haven’t bought a Model Y yet, now may be a better time than ever before.

100%: Are You A $TSLA Investor?

Here at InsideEVs, we don’t cover the Wall Street side of things too much; I leave that to the financial publications. But it’s an important part of any company’s story, and in Tesla’s case, it’s often the story.

So are you invested in Tesla? Would you be, after this? And if so, what’s your read on both the current state of things and the Musk’s pay?