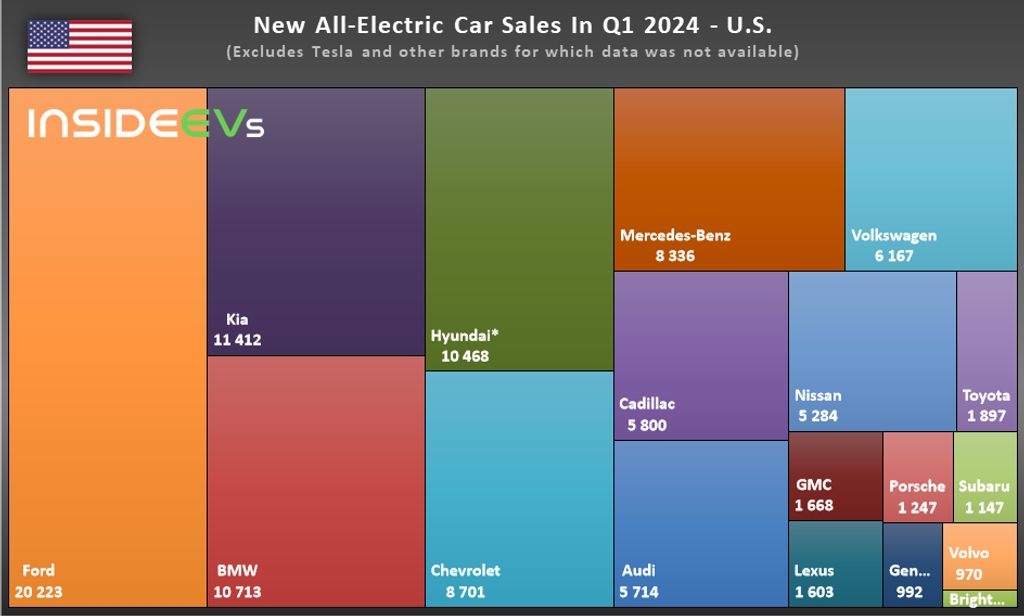

Ford is the only brand besides Tesla that sold over 20,000 EVs. Kia, BMW and Hyundai exceeded 10,000, while Cadillac’s EV share surged.

With the first quarter of 2024 behind us, it’s time to look at how electric vehicle sales are faring in the U.S. amid what many believe to be a slowdown in the rate of EV adoption. And while it has slowed down in some ways, several brands with strong EV games are doing well anyway—and there are a few surprise winners here too.

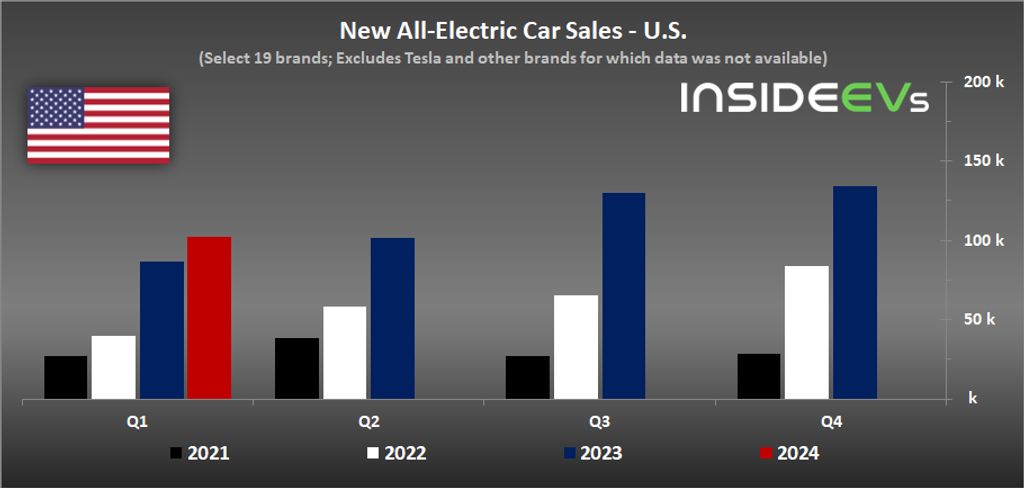

According to sales data analyzed by InsideEVs, during Q1 2024, the 19 brands we examined below sold over 102,000 all-electric vehicles. For this group, it’s the third-highest quarterly result ever. However, the year-over-year increase amounted to 18%, which is the slowest result for the group in a few years.

It is also crucial to note that this data looks at non-Tesla EV sales; you can find that company’s latest results here.

BEV sales surged in 2023

In 2023, all-electric car sales increased to about 1.1 million units (estimated). Out of that, no less than 450,000 were sold by traditional carmakers (up 83% compared to 2022). 2024 is predicted to be a potentially slower year as many consumers wait for more charging, cheaper options and new battery technologies to take off.

This group of non-Tesla brands includes traditional carmakers that report their all-electric car sales in the U.S., like Audi, BMW, General Motors’ BrightDrop delivery van division, Cadillac, Chevrolet, Ford, Genesis, GMC, Hyundai, Kia, Lexus, Mazda, Mercedes-Benz, Nissan, Porsche, Subaru, Toyota, Volkswagen and Volvo.

Not all manufacturers report their sales results in the U.S., especially the newer companies like Tesla, Rivian, Polestar, Lucid, Fisker and VinFast. They do not break out sales by country or region so their figures can’t be included in this report. They are also 100% electric already.

Several non-Tesla brands are missing from the group. Additionally, assuming that Tesla represents roughly half of all EV sales in the U.S. (probably well over 100,000) we can estimate that the U.S. total EV sales in Q1 were somewhere between 225,000-250,000.

EV Sales By Brands – Q1 2024

In Q1, just like in Q3 2023 and Q4 2023, Ford sold more all-electric vehicles (20,223) than any other non-Tesla brand in the U.S. It was the only result above 20,000 within the group.

Only three other brands exceeded a level of 10,000: Kia (11,412), BMW (10,713) and Hyundai (at least 10,468). In the case of Hyundai, we don’t have the number for the Hyundai Kona Electric, as its sales are lumped in with the gas-powered Kona.

A fifth-position finish for Chevrolet is a disappointment, but we know that the brand’s ramp-up issues with the Ultium platform, followed by software issues, played a role here. The brand no longer produces the popular Chevrolet Bolt EV/Bolt EUV duo, which underpinned most of its EV sales in 2023.

Overall, we can see a strong position for many premium brands, including BMW, Mercedes-Benz and most recently Cadillac.

* Excludes Tesla and other brands for which data was not available

** Hyundai sales without the Hyundai Kona Electric model

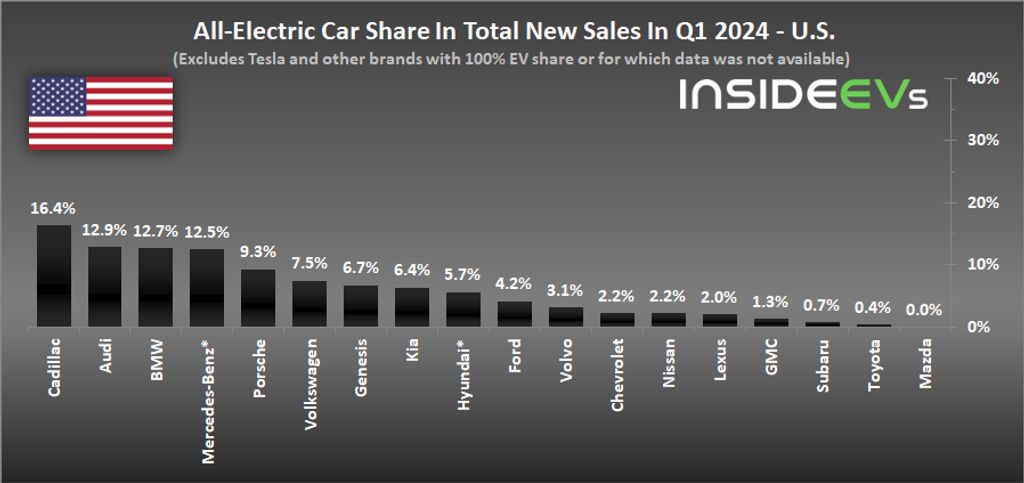

Now let’s look at the share of EVs out of the automaker’s total sales. This shows how advanced a carmaker is on its electrification journey to become 100% electric someday.

The list of brands includes only traditional ones, for which data is available. Brands that sell only all-electric cars are excluded because their share is always 100 percent.

In Q1, the highest EV share was achieved by Cadillac at 16.4%. It was a bit surprising but a very positive outcome for General Motors’s luxury arm. Cadillac’s EV share noticeably exceeded several German luxury brands (Audi, BMW and Mercedes-Benz) that all had 12+ percent results.

Volkswagen continued to be the number one mainstream brand in terms of EV share (7.5%), followed by Kia (6.4%), Hyundai (at least 5.7%) and Ford (4.2%). Chevrolet noted 2.2%.

* Excludes Tesla and other brands for which data was not available

** Hyundai sales without the Hyundai Kona Electric model

*** Mercedes-Benz (excluding vans)

For reference, the U.S. average EV share for traditional brands might be estimated at over 3% (assuming roughly 7% average EV market share, when including Tesla and other all-electric brands).

Stay tuned for more data on which brand is the most electrified; a separate report for automotive groups is coming next. If you are interested in seeing more detailed sales results for the individual brands, please check our previous reports:

Tesla EVs at V4 Supercharging station. From left: Model 3, Model S, Cybertruck, Model X and Model Y

Tesla EVs at V4 Supercharging station. From left: Model 3, Model S, Cybertruck, Model X and Model Y