The Silver Lining in Hertz’s Financial Struggles

Despite its initial positive outlook, Hertz’s large-scale adoption of electric vehicles (EVs) has encountered financial turbulence. The rental car leader aimed to pioneer the largest EV fleet in North America in 2021 by integrating numerous models from leading manufacturers like Tesla, General Motors, and Volvo. However, unforeseen market shifts, including drastic price reductions for new EVs in 2023, have escalated depreciation rates and repair costs, leading to substantial financial losses for Hertz.

Ongoing Challenges and Strategic Adjustments

Hertz’s vision of replacing gasoline-powered vehicles with EVs was initially celebrated but has since been deemed problematic, forcing significant operational changes. In a recent announcement, Hertz disclosed plans to increase private sales of its EVs by 10,000 units, targeting a total of 30,000 sales in 2024. The company revealed a staggering $195 million depreciation charge for its remaining EV inventory and noted an average increase of $339 in depreciation costs per vehicle, of which $119 is attributed directly to EVs.

Market Dynamics and Consumer Opportunities

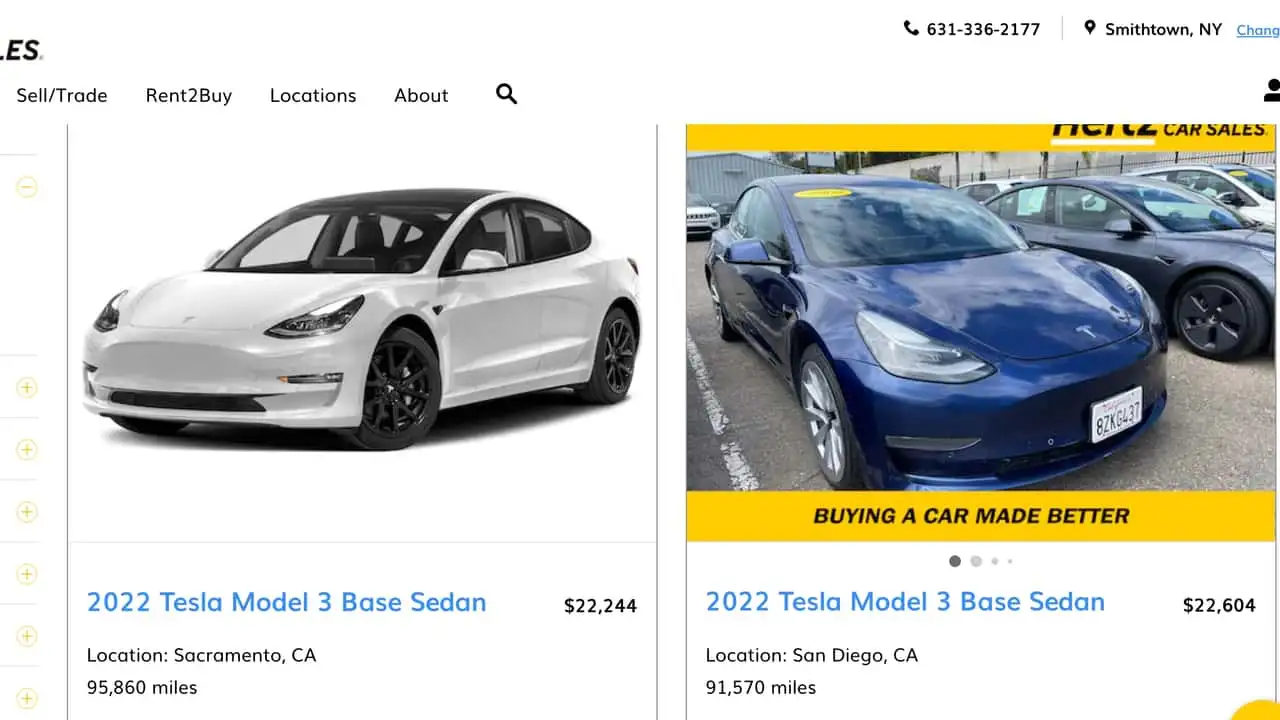

Despite the challenges, Hertz’s predicament presents a unique opportunity for consumers interested in affordable EVs. The company’s first-quarter report showed a $2.1 billion revenue, a slight increase from the previous year, yet it faced $567 million in losses due to hefty depreciation expenses. While the rental market remains robust, the influx of affordable, lightly used EVs from Hertz’s fleet offers a cost-effective option for consumers wanting to transition from gasoline to electric vehicles. Available through a dedicated sales portal, these EVs, including models like the Chevrolet Bolt and Kia EV6, are offered at significantly reduced prices, making them an attractive option for budget-conscious buyers.

Factual Additions and Emotional Engagement

Economic and Environmental Impact of EV Adoption

Hertz’s aggressive shift towards electric vehicles, while financially strenuous, underscores a broader commitment to sustainable transportation solutions. By making EVs more accessible through reduced pricing, Hertz not only addresses its inventory challenges but also contributes to environmental sustainability. This move potentially accelerates the adoption of electric vehicles, reducing overall carbon emissions and fostering a greener future.

Navigating Through Market Challenges

The journey of Hertz into the EV market highlights the complexities of adapting to rapidly changing automotive technologies and consumer preferences. Although the company faces financial hurdles, these challenges can pave the way for innovations and strategies that might redefine the rental and automotive industry. The resilience and adaptability Hertz demonstrates could inspire other companies to pursue similar transitions, albeit with more cautious planning and risk assessment.

A Catalyst for Change in Consumer Behavior

For consumers, Hertz’s current situation offers more than just the opportunity to purchase an EV at a lower cost; it serves as a catalyst for a broader shift in transportation preferences. By choosing to invest in a used EV, consumers are not only taking advantage of a financial deal but are also participating in a movement towards more sustainable and innovative transportation options. This shift could significantly influence the pace at which society moves away from fossil fuels and embraces cleaner, more sustainable vehicle technologies.