Kia’s Electric Vehicle Sales Surge in April 2024

Record-Breaking EV Sales Achievements

In an unprecedented surge, Kia America marked a significant milestone by selling approximately 5,000 all-electric vehicles in April 2024 alone. This achievement comes amidst a slight 3.6% dip in overall vehicle sales from the previous year, totaling 65,754 units in April. Despite a year-to-date decrease of 2.8%, resulting in 245,375 vehicles sold, Kia’s electric vehicle (EV) sector showed remarkable growth, more than doubling its sales figures compared to the same period last year.

Details of Kia’s Electric Expansion

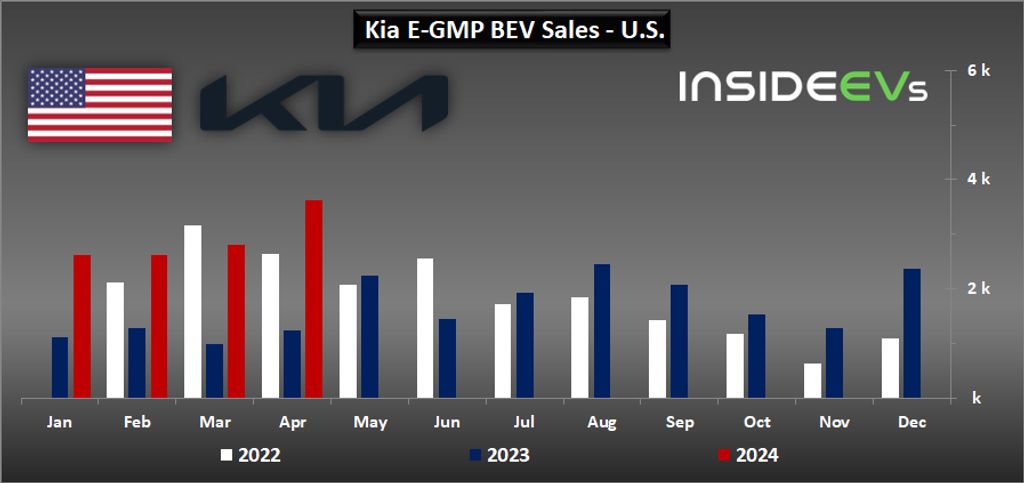

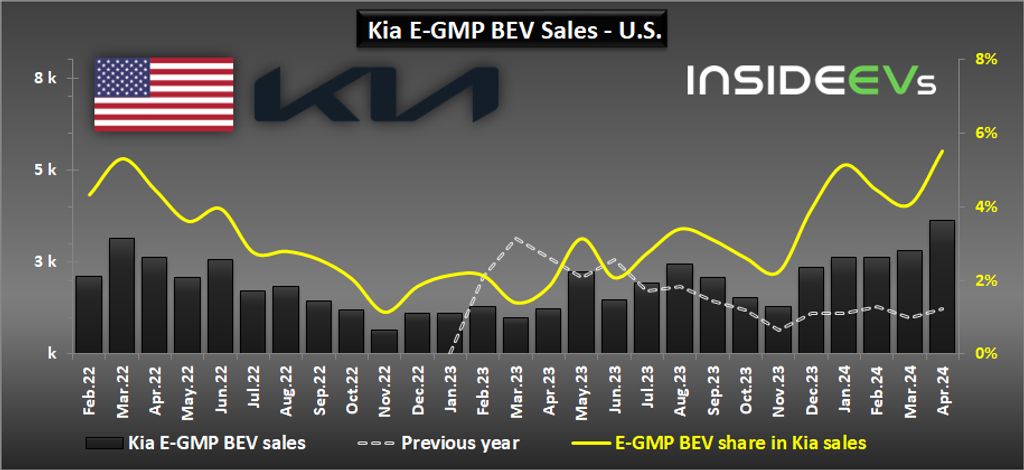

Kia’s aggressive push into the electric market is underscored by robust sales across its EV models, particularly those built on the E-GMP platform—namely the EV6 and EV9—alongside the versatile Niro EV. In April alone, sales of the E-GMP-based EVs reached 3,623 units, a dramatic 192% increase year-over-year, accounting for 5.5% of Kia’s total sales volume for the month. The breakdown includes 2,051 units of the EV6 (up 65% year-over-year) and 1,572 units of the EV9, setting a new sales record for the latter.

Kia’s Strategic Moves and Future Outlook

Kia’s commitment to expanding its EV lineup is further evidenced by its plans to start local production of the Kia EV9 in West Point, Georgia, as of May 2024. The company’s strategic positioning is enhanced by the anticipated full $7,500 federal tax credit expected by 2025, ensuring competitive pricing and accessibility for U.S. consumers. Kia’s executive team, including Eric Watson, vice president of sales operations, has expressed optimism about continuing this strong sales momentum, bolstered by upcoming releases like the new Sorento and refreshed models of the Carnival and K5.

Impact and Future Directions in EV Market Presence

Kia’s strategic efforts in the EV market are not only redefining their brand identity but also setting new standards in automotive innovation and consumer choice. By effectively leveraging federal incentives and expanding local manufacturing capabilities, Kia is poised to enhance its market share and customer base in the U.S. This strategic focus on electric vehicles, combined with a diverse range of models, allows Kia to meet growing consumer demands for sustainable and efficient transportation solutions, further solidifying its position as a leader in the global automotive industry.